Fund & Asset Managers revolutionise your KYC Process

At last a KYC process your customers and compliance team will love

By enabling customers to create a wallet –’ investment passport ’, VerifiMe® facilitates seamless and secure data sharing with trusted organisations, revolutionising the way individuals manage their financial relationships while ensuring compliance and security.

Don’t just take our word for it

Fund and Asset Managers’ Single-Step Solution For Customer Due Diligence

Stop handling and requesting personally identifiable information

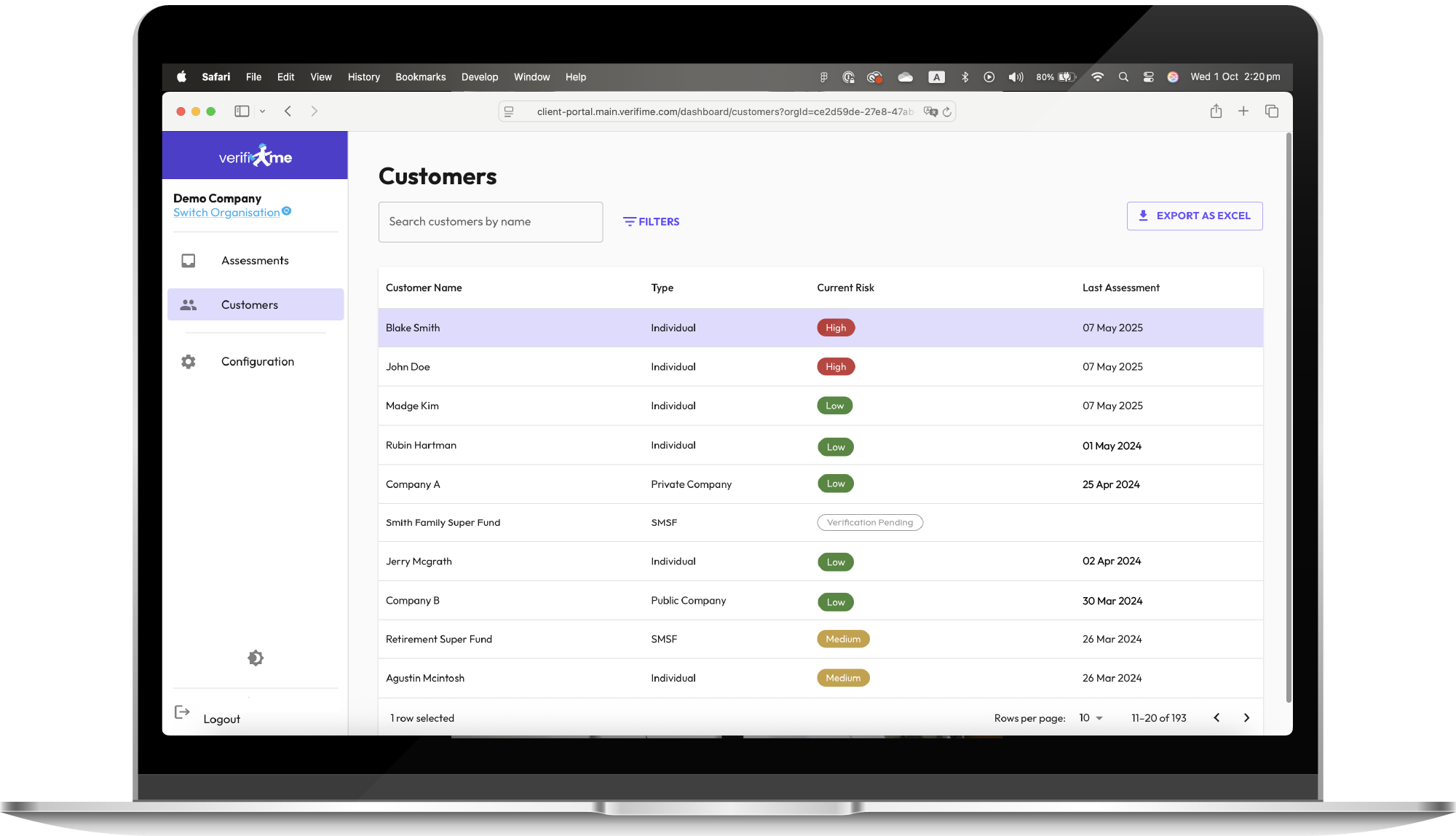

Monitor AML/CTF and KYC compliance in real-time

Assess customers against your rules to produce customer risk outcomes

Mitigate risk outcomes and record required customer due diligence

Streamline Wholesale Certificate verification

Save on processing time and costs

Secure your customers data and help them through the KYC process with other service providers

Revolutionising KYC/KYB to Achieve Your AML/CTF Objectives

-

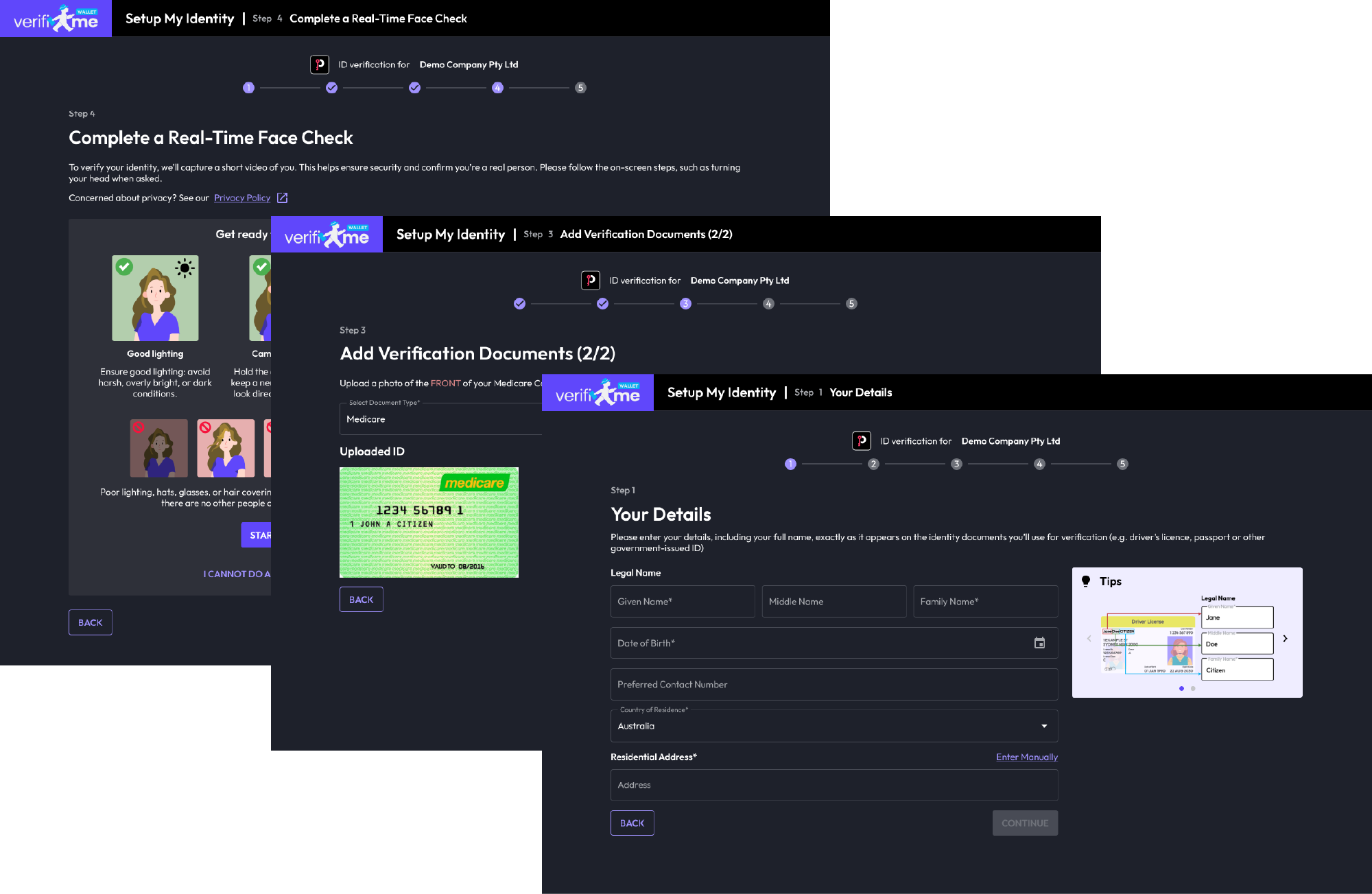

Limit fraud with biometrics and liveness

Significantly reduce the risk of fraud and ensure the safety of your customers. Say goodbye to uncertainty and eliminate the possibility of unauthorised individuals acting on others’ accounts.

-

End to end customer due diligence

Set your rules through our first-to-market automated rules and risk mitigations engine. Set automated or manual mitigations for assessment and risk quantification. Set up future enhanced due diligence or ongoing due diligence to make KYC a perpetual process.

-

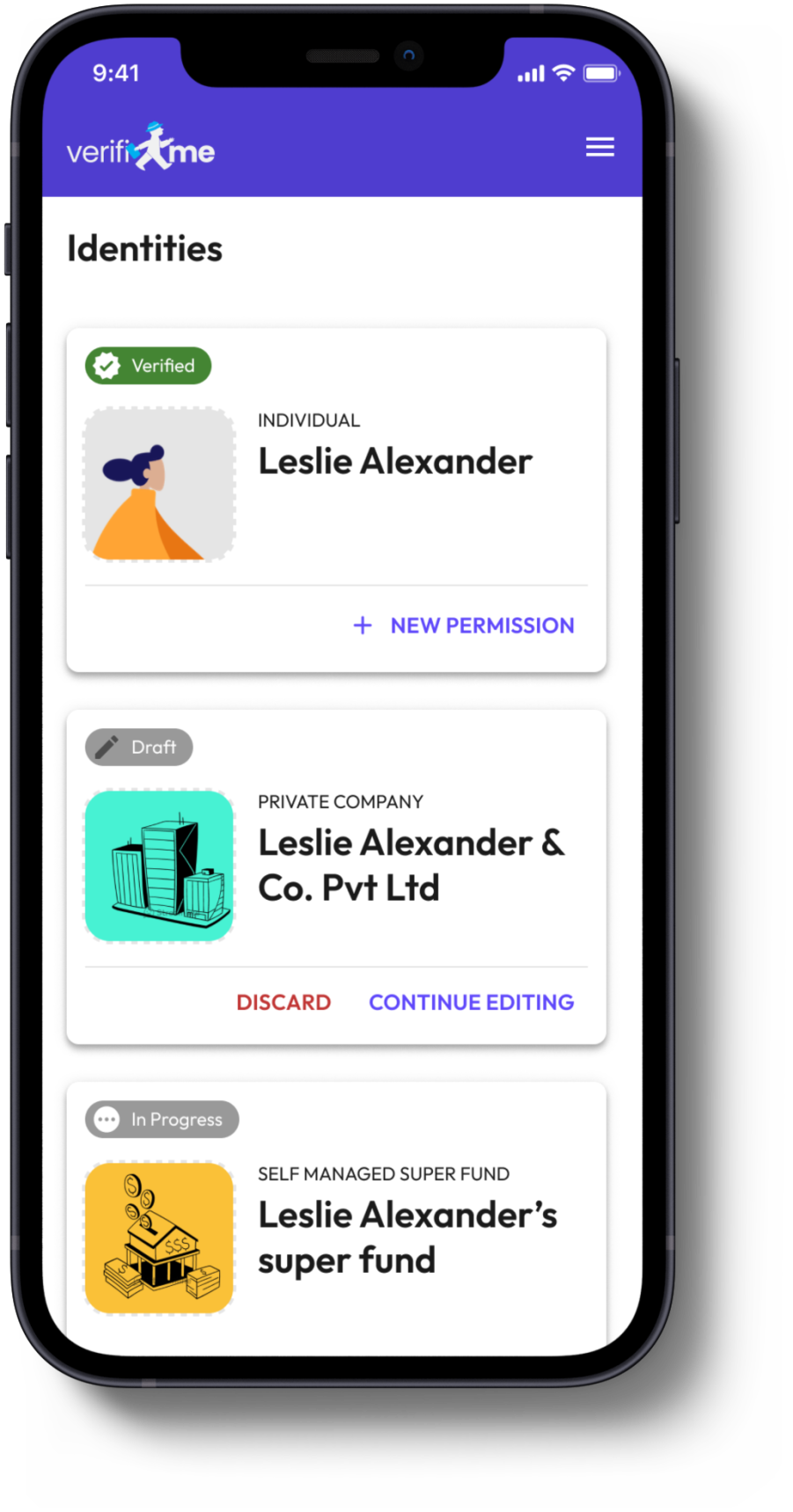

A unique shareable solution

Upon completing the verification process, customers are able to secure their wallet and easily share their verified credentials when needed. This innovative method empowers customers by giving them control over their personal and organisational data, eliminating the need for constant sharing.

-

Privacy and security

VerifiMe has been built and deployed to a global best of breed security standard protecting our clients. Whilst our tokenising of credentials in a shareable wallet eliminates further risk of privacy breaches in terms of sending or exposing personal/organisational information.

Why should Fund and Asset Managers choose VerifiMe®?

Benefits to Fund & Asset Managers:

✅ Make the KYC process easier for customers

✅ Easily integrated into existing systems for a smooth transition

✅ Eliminate identity fraud and other security risks

✅ Comprehensive remediation: Combining technology and experience

Benefits to Customers:

✅ A single digital ID wallet to store all legal entity credentials

✅ Upload and verify once, bring an end to the repetition

✅ Retain control over sharing personal data with permissions

✅ Easy to set up and use

VerifiMe Solution. Start now with 3 Steps

-

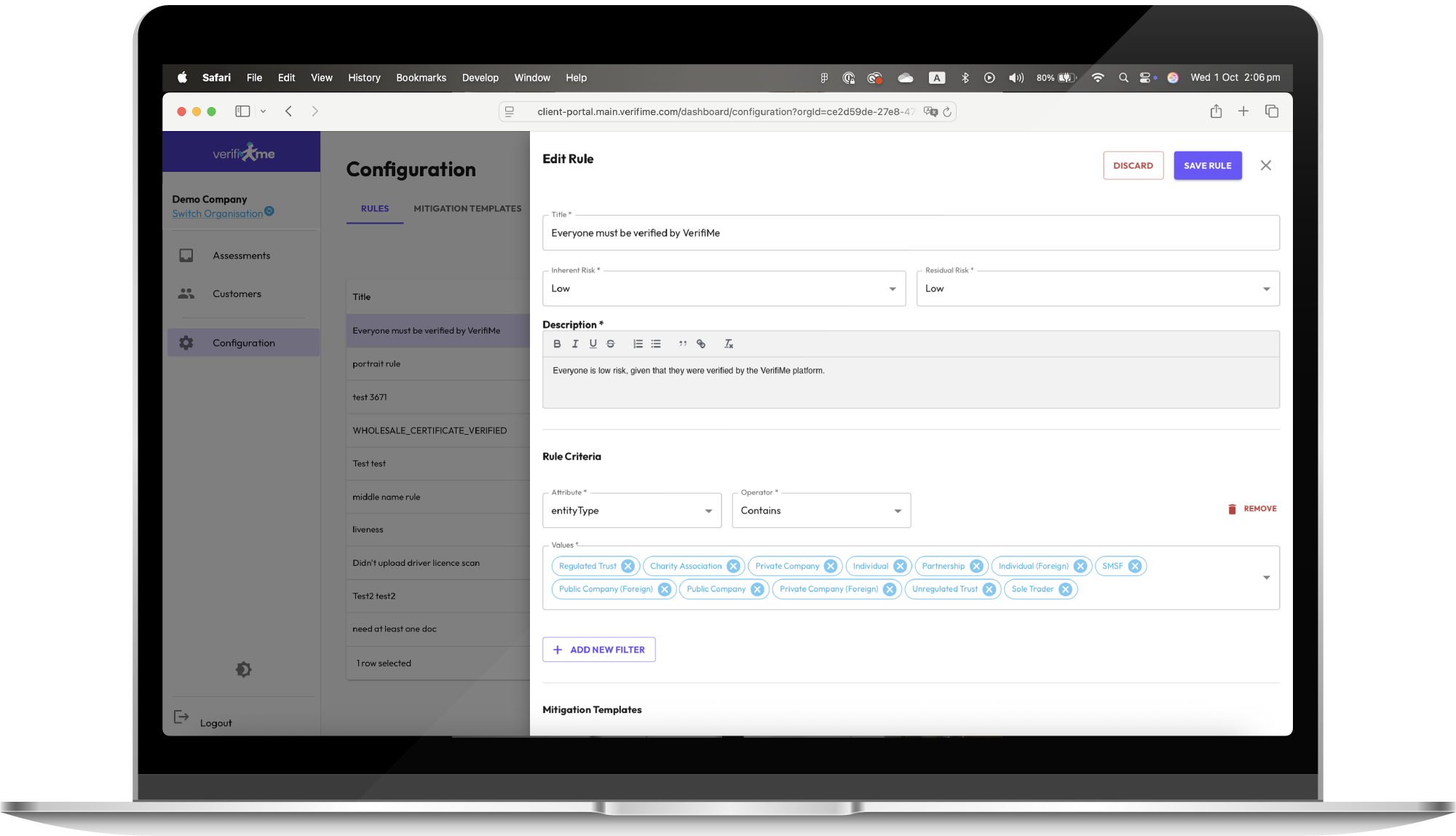

Step 1: Configure Your Compliance Rules

Set up risk categories and compliance policies that match your regulatory requirements. Define assessment criteria, mitigation templates, and your risk appetite—build the foundation for automated decision-making.

-

Step 2: Design Your Onboarding Workflow

Map what data you need for each customer type and choose collection methods. Configure VerifiMe's KYC/KYB orchestration to gather documents and assess risk automatically.

-

Step 3: Assess and Audit with Confidence

Evaluate customers against your risk rules, monitor for changes, and generate compliant reports. Every decision is documented with a complete audit trail for regulators.

Verify with VerifiMe®

Our “Verify with VerifiMe®” plug-in and software development kit (SDK) can be seamlessly integrated into your existing online KYC or onboarding process. Our experienced team will assist you in combining our APIs to deliver a tailored solution that meets your specific needs.

API integration that empowers you to connect seamlessly and securely to an existing customer experience.

API first, modular architecture and a comprehensive API ensure a no-fuss integration

Enterprise-ready, scaleable and reliable fit for any use case from simple KYC to complex KYB customer due diligence

Return risk-based outcomes of KYC/KYB with access to mitigations and reporting

All Your AML/CTF Tools in One Place

Company

Australian Owned

20 years of AML- CTF services experience

Accredited Government Gateway Services Provider

ISO Accredited

Australian based data services

Verification Tools

Global document verification

Inline document and biometric verification

Secure sharing of verified credentials with biometric face match

Shareable identity wallet adds value in the process

Fraud prevention with face matching and liveness detection AI

Verify proof of assets or source of wealth

Ability to verify complex organisations and controllers, and beneficiaries

AML Screening – PEP, Sanctions or Adverse Media screening

Compliance & Audit

Rules engine triggers automated outcomes and assessment needs

Privacy protected through zero-knowledge proof

Full reporting and audit trail

Automated rules and risk mitigations

Fraud prevention with face matching and liveness detection AI

Risk assessment and scoring

Customer consent built into every step of data sharing AML Screening – PEP, Sanctions or Adverse Media screening

Ready for a Solution that Takes the Friction out of Customer Due Diligence

Get in touch today to see how joining the VerifiMe® network can transform your business.

Frequently Asked Questions for Fund and Asset Managers

-

Fund/Asset managers must comply with stringent AML obligations, including:

Conducting customer due diligence (CDD) and enhanced due diligence (EDD) on investors.

Monitoring fund inflows and outflows for suspicious transactions.

Reporting any unusual activities to the relevant authorities.

Maintaining detailed records of compliance activities for audits.

VerifiMe® ensures these requirements are met efficiently with its robust AML software for banks and fund managers.

-

The VerifMe® solution for Fund/Asset managers include:

Quick and secure client on-boarding.

Risk-based client segmentation and enhanced due diligence for high-risk investors.

Seamless integration with fund management platforms.

Scalable solutions suitable for both small and large firms.

-

Yes, ongoing transaction monitoring is a critical component of AML/CTF compliance for fund managers. The VerifiMe® software provides real-time monitoring, flagging unusual activities and ensuring adherence to fund management AML regulations.

-

Failure to meet AML and KYC obligations can result in:

Hefty financial penalties.

Reputation damage and loss of client trust.

Potential legal action and suspension of operations.

VerifiMe® helps fund managers avoid these risks with reliable and compliant solutions.