Tranche 2 AML/CTF Compliance for Legal & Professional Services Firms

Meet compliance requirements with VerifiMe®

Minimise risk and comply with future Tranche 2 AML/CTF requirements?

Simple, deployable and configurable platform for customer due diligence and AML/CTF compliance

“At Blackbay, securely verifying our new clients’ identities is crucial. VerifiMe’s seamless verification solution saves time and eliminates the need to handle personally identifiable information, thereby assisting compliance and efficiency. Highly recommended for legal professionals seeking streamlined and secure verification processes.”

Single-Step Solution For Customer Verification

Handle personally identifiable information safely and securely today

Be Tranche 2 ready for AML/CTF compliance

Configurable rules for tailored compliance

Save on processing time

Reduce your data handling risk

Deliver a professional level of customer due diligence

Why Should Legal and Professional Service Firms Choose VerifiMe®?

Benefits to the Firm:

✅ Software as a service with no software downloads

✅ PII management risk reduced

✅ Real time monitoring of AML/CTF compliance means you will be Tranche 2 ready

✅ AUSTRAC-ready platform created by a practicing Australian lawyer with deep regulatory compliance expertise

✅ No lock-in contracts or upfront ongoing payments

Benefits to Customers:

✅ A single digital ID wallet to store all legal entity credentials

✅ Upload and verify once, bring an end to the repetition

✅ Retain control over sharing personal data with permissions

✅ Free to set up and use

VerifiMe Solution for Tranche 2 Entities. Start now with 3 Steps

-

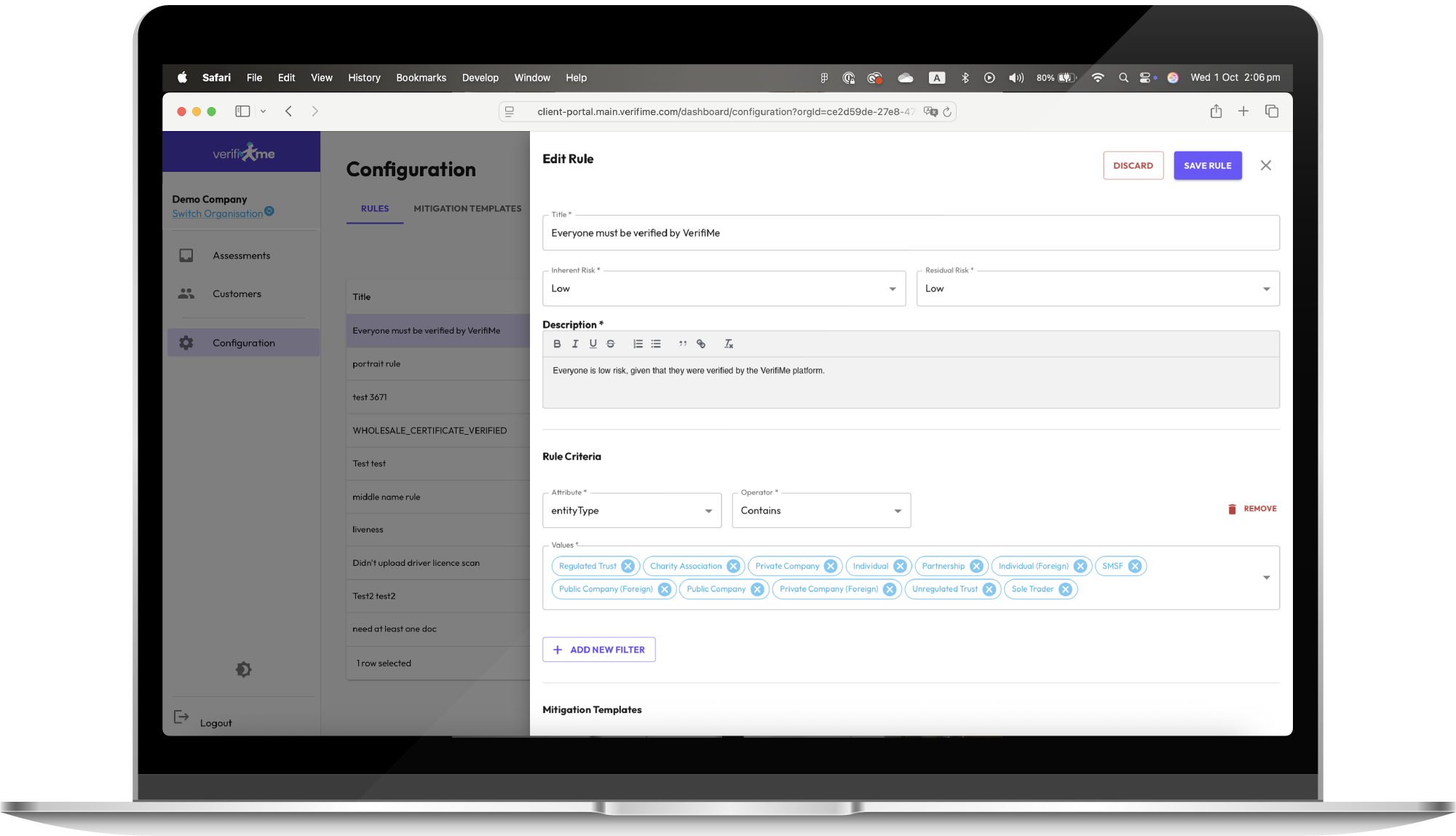

Step 1: Configure Your Compliance Rules

Set up risk categories and compliance policies that match your regulatory requirements. Define assessment criteria, mitigation templates, and your risk appetite—build the foundation for automated decision-making.

-

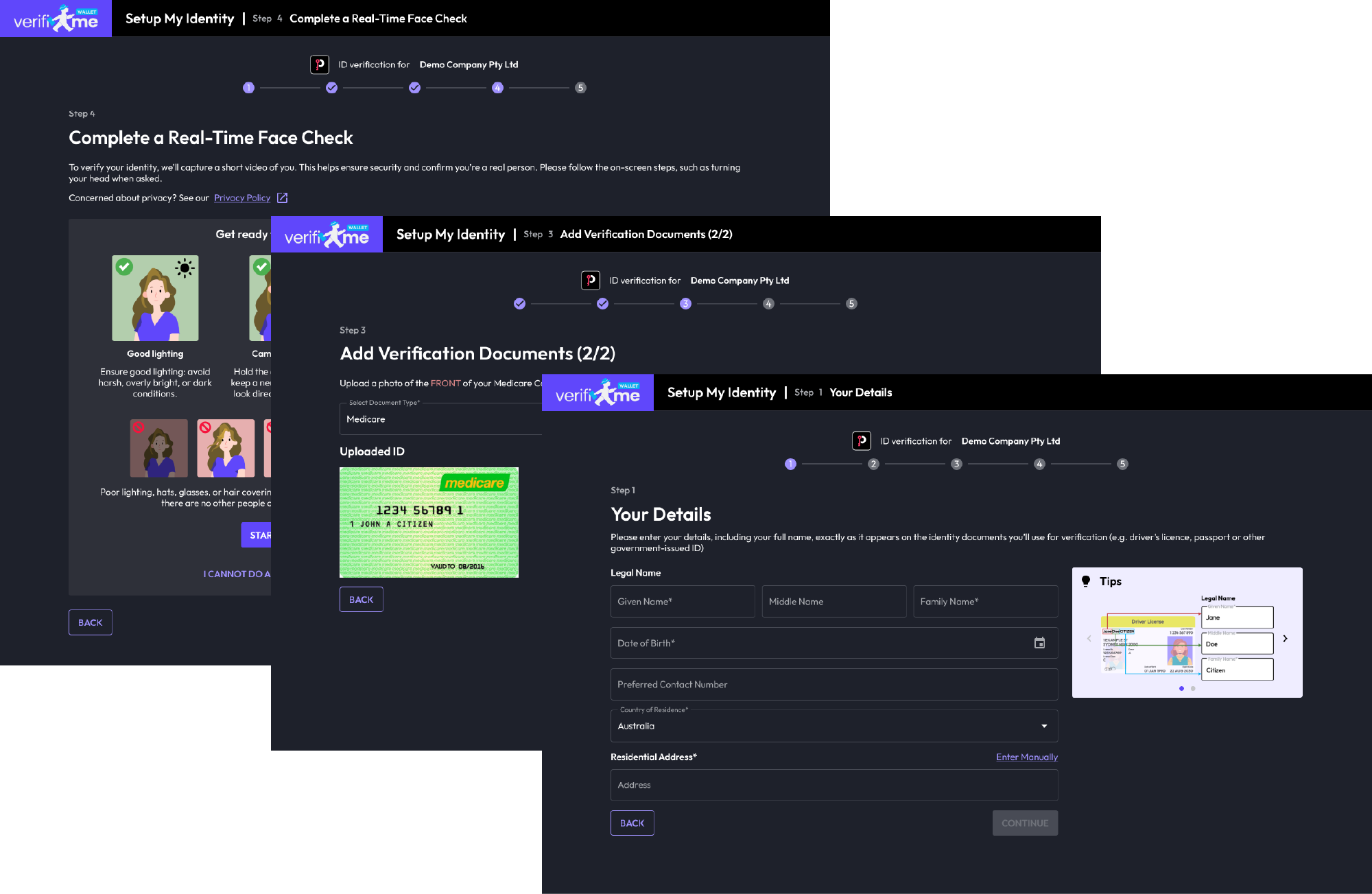

Step 2: Design Your Onboarding Workflow

Map what data you need for each customer type and choose collection methods. Configure VerifiMe's KYC/KYB orchestration to gather documents and assess risk automatically.

-

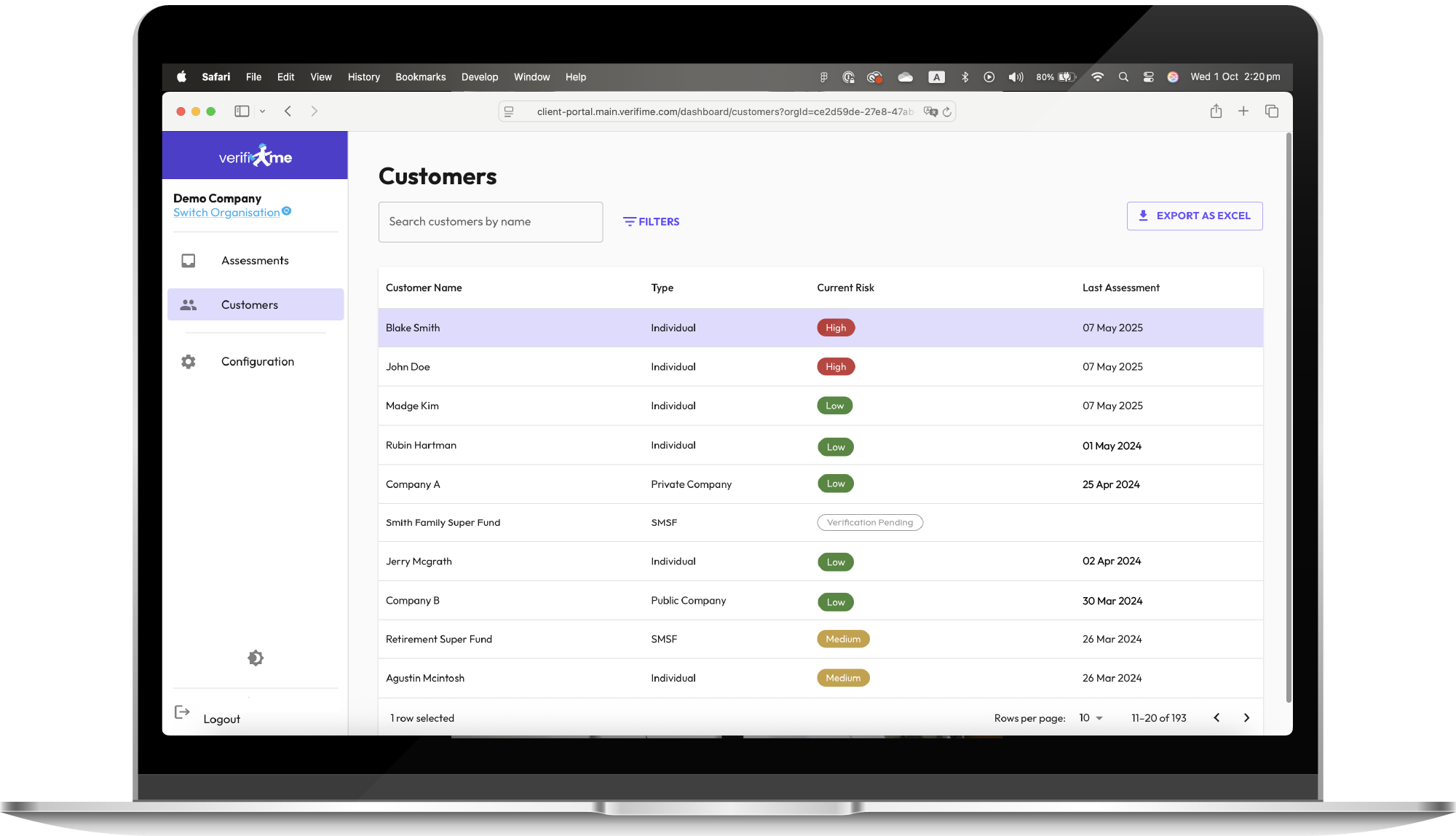

Step 3: Assess and Audit with Confidence

Evaluate customers against your risk rules, monitor for changes, and generate compliant reports. Every decision is documented with a complete audit trail for regulators.

Frequently Asked Questions for Lawyers

-

Lawyers and law firms will be required to:

Conduct thorough KYC checks, including identity verification and risk assessments, for all clients.

Monitor transactions to identify suspicious activities.

Report any red flags to the relevant authorities as per AML/CTF regulations.

Keep accurate and secure records of client and transaction data.

VerifiMe® has AML/CTF, KYC software for law firms which ensures your obligations are met efficiently and accurately.

-

he rules governing Customer Due Diligence (CDD) for law firms are found in Part 6 of the AML/CTF Rules 2025

-

KYC software for law firms helps automate and simplify the compliance process by:

Conducting real-time identity verification and risk assessments.

Monitoring transactions for potential AML violations.

Generating detailed, audit-ready compliance reports.

Keeping your practice aligned with evolving AML/CTF regulations.

VerifiMe offers specialized AML /CTF solutions tailored for legal professionals, saving time and reducing the risk of errors.

-

While existing practices might focus on professional conduct and fraud prevention, AML/CTF CDD specifically targets money laundering and terrorism financing (ML/TF). It involves a structured approach utilising risk assessment, enhanced due diligence, and suspicious activity reporting.

-

CDD requires a formal process that includes:

• Formal risk classification (low, medium, or high).

• Verification of the customer’s identity (KYC).

• Identification of beneficial ownership beyond just client representatives.

• Verification of the source of wealth/funds for high-risk customers.

• Ongoing transaction monitoring.

-

Law firms must apply a risk-based approach to CDD. This involves formally documenting the risk classification of the customer (low, medium, or high)

-

Law firms must document the individual's full name and any aliases, verify their identity (including primary photographic ID, secondary identification, and address verification), perform a risk assessment, and conduct Politically Exposed Persons (PEP) and Sanctions screening

-

Due diligence for corporate entities must go beyond simple director verification and authority documentation to include:

• Verification of entity registration.

• Complete beneficial ownership mapping.

• Corporate structure analysis.

• Industry risk assessment

-

For trusts, law firms must verify the trust deed, identify the trustee and beneficiaries, and complete enhanced due diligence steps, including:

• Trust type classification.

• Complete beneficiary mapping.

• Settlor verification.

• Enhanced screening.

-

VerifiMe® provides cutting-edge KYC solutions designed specifically for lawyers. Our platform:

Verifies client identities quickly and securely using advanced digital tools.

Allows legal firms to verify new clients and set a high standard of compliance as well as limit risk of PII data handling.

Tracks and manages client records to ensure ongoing compliance.

Integrates seamlessly with legal practice management systems.

-

Yes, the VerifiMe® solution is scalable, making it ideal for law firms of any size. Whether you’re an independent practitioner or part of a larger firm, VerifiMe® helps you stay compliant efficiently and affordably. Talk to our clients if you are not sure.

VerifiMe®: A Solution for Legal Firms

Get in touch today to see how joining the VerifiMe® network can transform your business.