End the endless identity verification cycle

Plans from just $25 per month

VerifiMe® is a unified risk management platform that automates your entire customer due diligence process. Design KYC and KYB workflows that match your risk appetite, connect directly to government identity verification services, and screen against thousands of global databases for sanctions, adverse media, and Politically Exposed Persons. Set your compliance policies once, then let automation handle the rest.

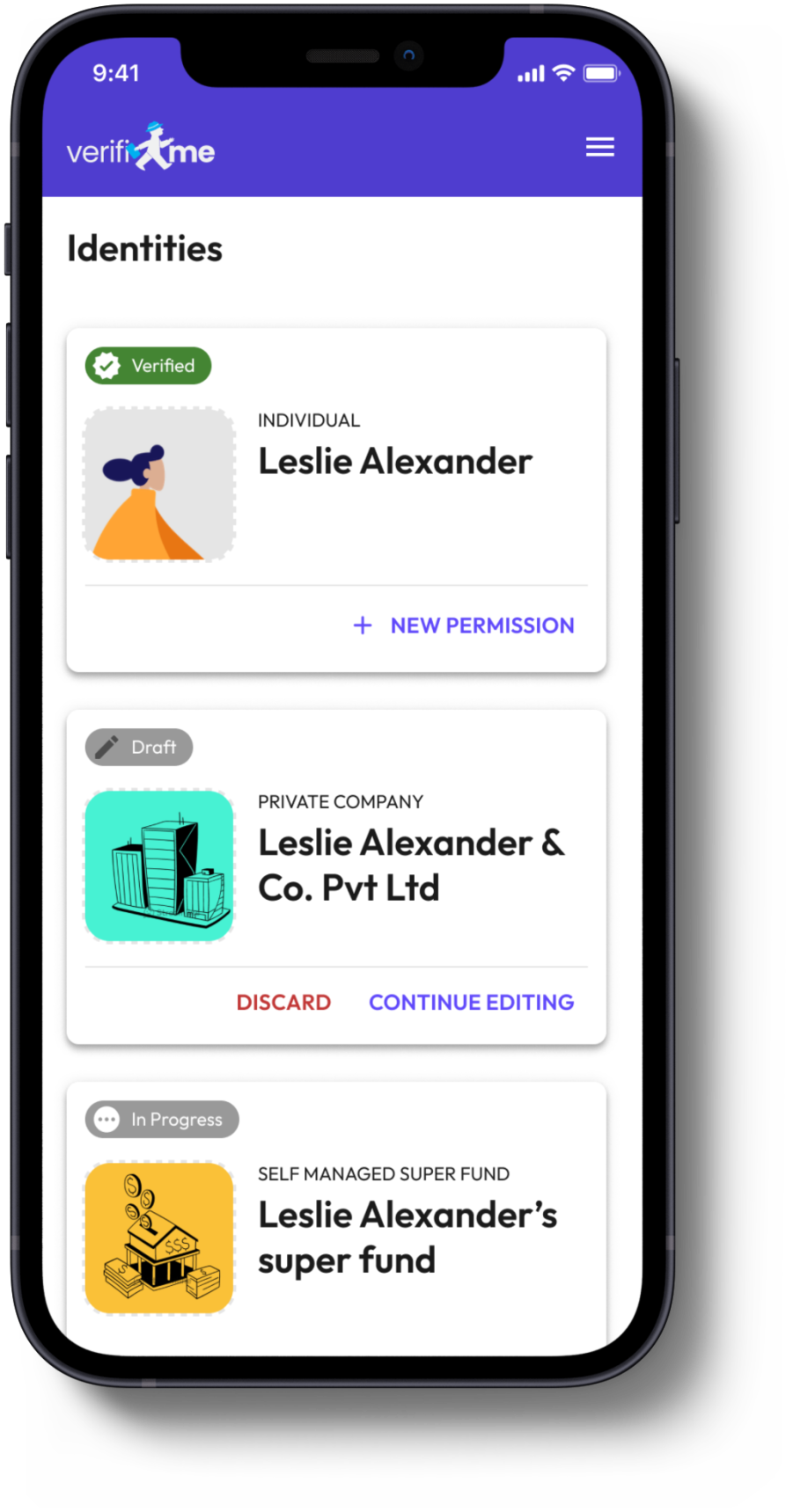

What sets VerifiMe® apart: our innovative reusable identity wallet empowers customers to own their verified credentials, dramatically improving their experience while streamlining your ongoing due diligence requirements.

Shareable Personal & Business Identity Verification: KYC, KYB and AML/CTF Software Built for Privacy and Control

-

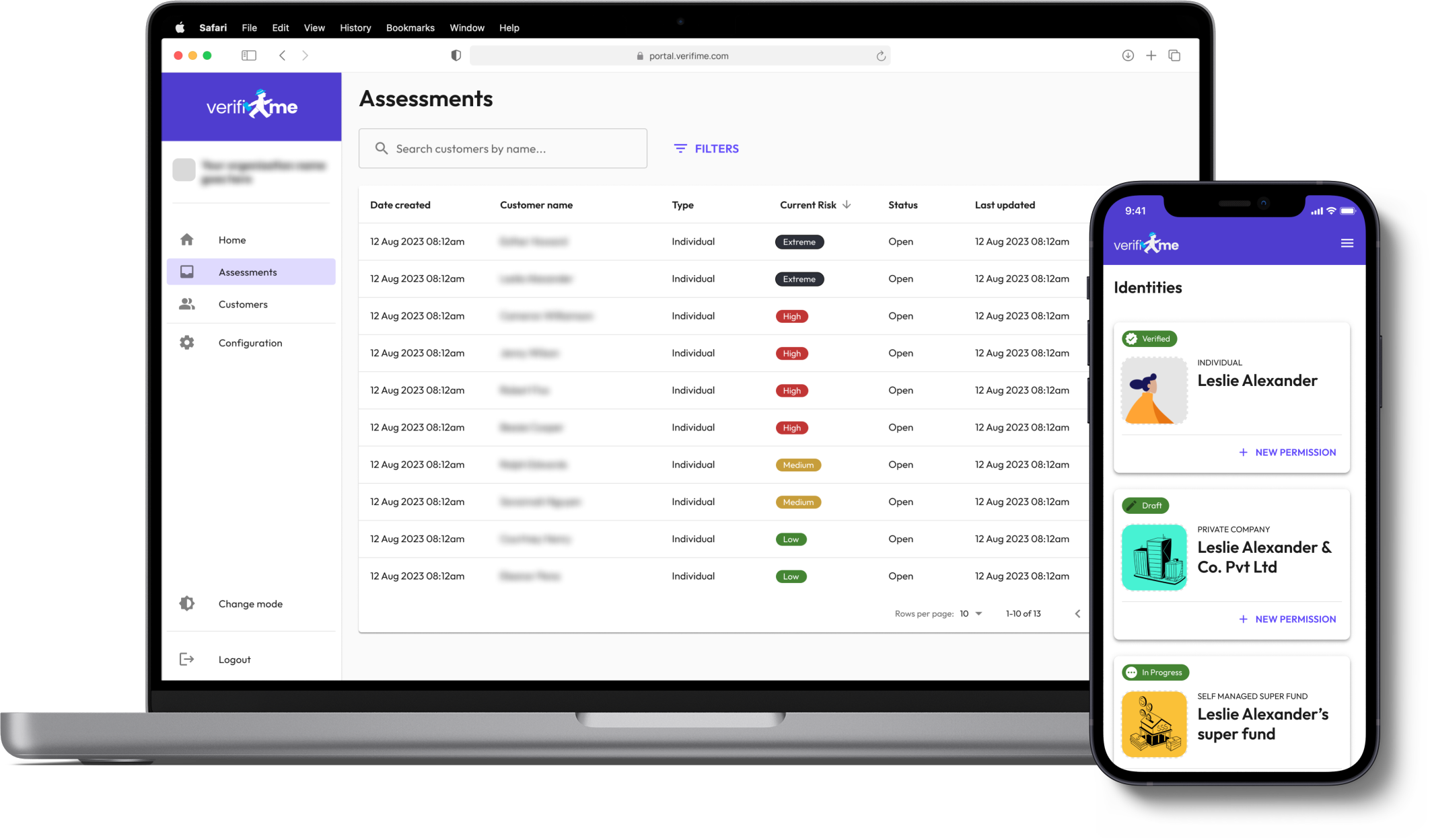

Customer risk intelligently assessed and scored

Unlike basic pass/fail verification systems, VerifiMe delivers sophisticated risk scoring tailored to your specific business rules and compliance requirements. True customer understanding requires nuanced analysis, not binary outcomes.

-

Zero-knowledge privacy protection

VerifiMe's proprietary technology eliminates the need to store or handle Customer Personally Identifiable Information through advanced zero-proof knowledge protocols. Your customers' sensitive data stays private while verification remains complete.

-

Shareable credentials - streamlined and secure

Aligned with emerging regulatory frameworks for shareable digital identities, VerifiMe enables customers to verify once and securely share their information across multiple services. No more repetitive document uploads or verification fatigue - just seamless, consent-based credential sharing.

-

Comprehensive business verification (KYB)

VerifiMe transforms organizational verification by providing complete transparency and control. All significant controllers and beneficial owners are automatically notified when their information is accessed, creating an unprecedented level of accountability in business identity verification.

-

Customer-controlled consent management

Every verification and sharing decision remains in your customers' hands. Unlike traditional identity solutions, VerifiMe integrates dynamic consent management throughout the entire process, allowing customers to grant, modify, or revoke sharing permissions at any time - for both personal and business identities.

The Complete KYC & KYB Verification Platform

Transform your customer onboarding with the VerifiMe® all-in-one compliance solution. Our KYC software integrates seamlessly with existing systems while providing advanced fraud detection, biometric authentication, and comprehensive audit trails for regulatory compliance.

AML/CTF Screening

✔ PEP and Sanction checks: Screen against millions of global entities and individuals

✔ Adverse Media Monitoring: Comprehensive media screening to identify and mitigate customer risks

Compliance and Audit

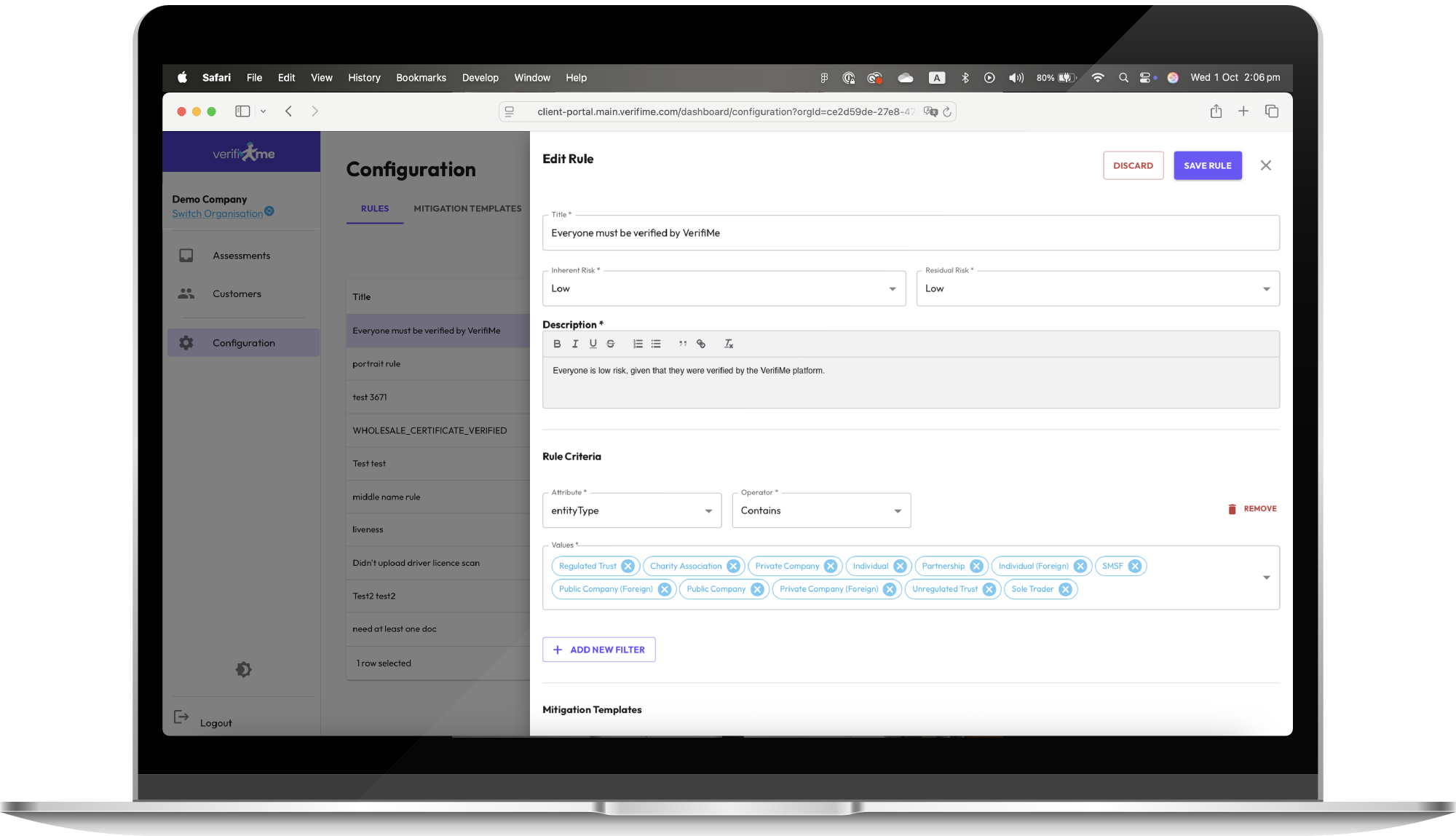

✔ Compliance Management: Configure compliance rules and automated/manual mitigations

✔ Risk Assessment: Conduct comprehensive risk assessments and categorisation

✔ Intelligent Automation: Deploy smart rules for seamless compliance workflows

✔ Audit Trail: Maintain detailed audit logs with advanced reporting capabilities

✔ Privacy First Protection: Eliminate the need to store PII using selective disclosure and zero-knowledge proofs

Ongoing Monitoring

✔ Fraud Detection : Detect duplicate documents and biometric anomalies before fraud occurs

✔ Biometric Recreening: Utilise face verification for continuous identity monitoring and control

✔ Ongoing AML Monitoring : Schedule screening triggers based on dynamic risk assessments

✔ Transaction Monitoring: Intelligent reassessments through both automated triggers and manual oversight

Individual KYC Verification

✔ Global Document Verification: Verify thousands of document types from around the world

✔ Seamless Process: Automated document and biometric verification in one flow

✔ Australian Government Accredited: Certified Government Gateway Service Provider

✔ AI-Powered Fraud Prevention: Advanced face matching and liveness detection technology

✔ Address Verification: Comprehensive address validation and proof of residence

✔ Built-in Customer Consent: Integrated consent management at every step of data sharing

✔ Credential Declarations: Verify supporting credentials for registrations, investor sophistication, and asset ownership

Business Verification KYB

✔ Organisational Insight: Comprehensive understanding of complex business structures

✔ UBO Verification: Identify and verify ultimate beneficial owners and organisational controllers

✔ Multi-Layer Screening: Integrated PEP, sanctions, and adverse media screening

Shareable and Secure Digital Identity

✔ Verified Credential Wallet: Customers own reusable digital credentials for seamless future identity sharing

✔ Enterprise Security: Multi-factor authentication and passkey support to protect sensitive data

Connect to Any Platform

Integrate VerifiMe's verification capabilities directly into your existing systems through our developer tools.

Widget Integration

Embed our "Verify with VerifiMe®" button into your customer onboarding flows. Your customers verify once, you access results instantly.

API Access

Pull verification outcomes directly into your systems for automated reporting, reconciliation, and compliance workflows.

Real-Time Notifications

Receive risk assessment results via email or webhook with one-click access to complete any required actions.

Built for Scale

From basic identity checks to comprehensive AML/CTF due diligence, our infrastructure handles simple integrations to complex compliance rules.

Access Developer Documentation →

Work with a team that can deliver more than just software!

Support Services

We understand implementing is often the hardest aspect of any compliance program and resources are always stretched. Our specialist team will support your ongoing administration needs when other stuff gets in the way. Our experience and legal support provides on demand or agreed ongoing help.

Range of Specialist Partners

You don’t just need software - you need a plan, training, bench marking and expert advice to ensure you are implementing compliantly. We have a number of expert providers who can have you up and running easily.

Project Delivery

Our team brings unmatched experience and expertise to handle complex projects, including complex remediation programs and customer updates and consolidation ahead of a transition or change in service provider e.g. fund administrator or registry.

Document Verification Process

Document verification is a critical component of customer due diligence, mandated by AML/CTF regulations and professional service standards. It ensures that individuals are who they claim to be, helping organisations mitigate identity fraud and meet compliance obligations.

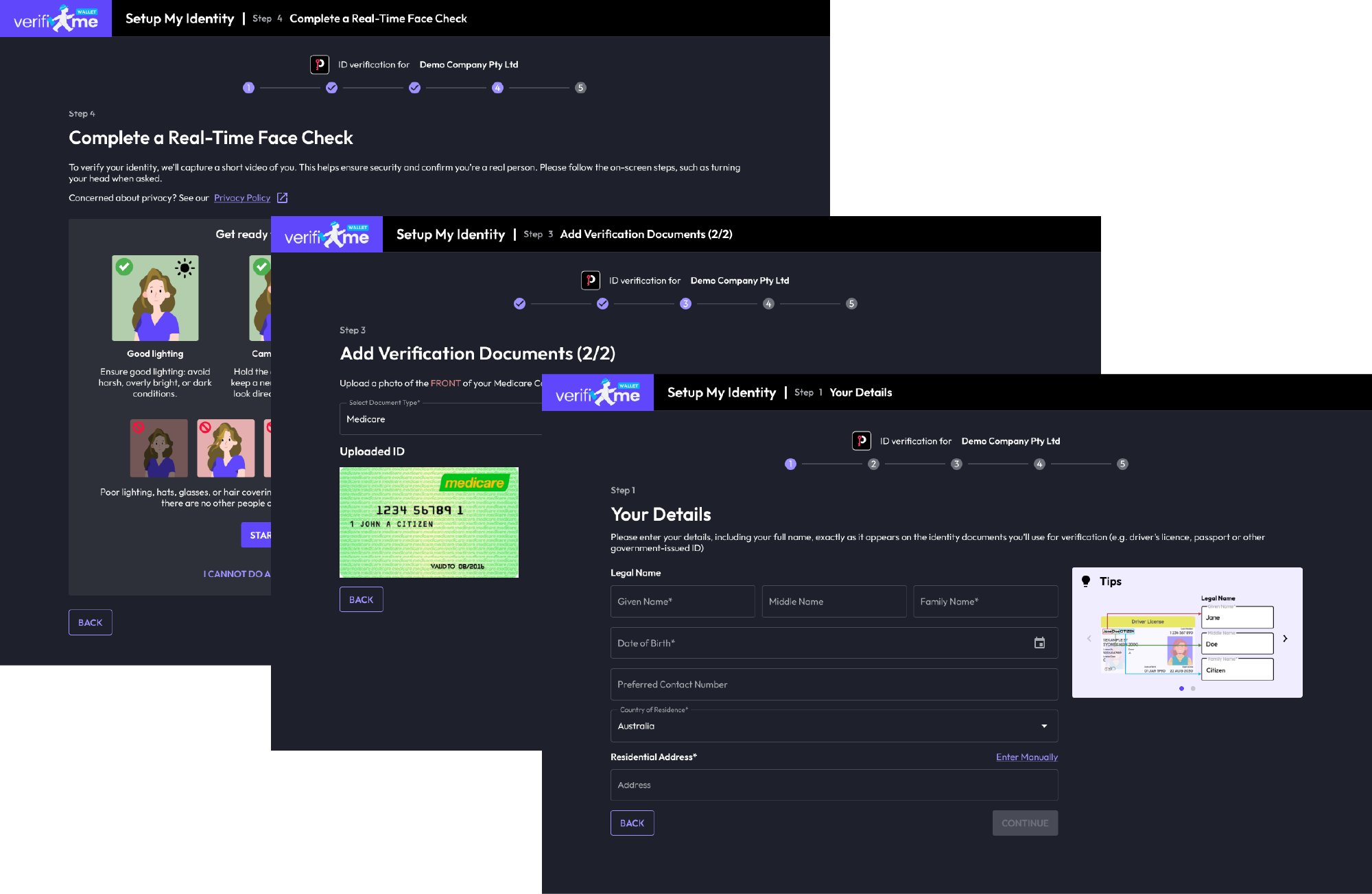

Three-Step Verification Process

1. Document Capture

The process begins with the secure electronic capture of an identity document—such as a passport or driver’s license—via a user’s device. Our system performs hundreds of automated checks in seconds, analysing the document for: Image quality and clarity; Signs of tampering or forgery; Authenticity and validity; Presence of security features (e.g., watermarks, holograms, foils, textures); Completeness and structural integrity

Once the document is validated, the extracted data is cross-checked against the personally identifiable information (PII) provided earlier—such as full name, date of birth, and address.

2. Document Data Matching (Optional)

For enhanced verification, document data can be matched against authoritative government databases.

In Australia, for example, this includes the IDMatch Gateway Service.

If inconsistencies are detected, the user may be prompted to provide additional documentation or verification.

3. Biometric Face Check

A biometric image (selfie) is captured and compared to the photo on the identity document using facial recognition technology. This Face Check generates a similarity score to confirm that the person submitting the document is its rightful owner.

VerifiMe’s Integrated Solution

VerifiMe incorporates all three verification stages into its core platform. Its configurable Rules Engine allows organisations to tailor the process based on their risk appetite and compliance needs, including: Required document types and formats; Government database verification preferences; Risk-based decision-making workflows

This flexibility supports stronger identity assurance and more effective customer risk management.

AML/CTF Compliance SaaS

All the checks you need, for any regulation, market or use case.

Customer due diligence compliance and fraud protection aren’t one-size-fits-all. Get the solution that fits your needs today and deliver a positive customer outcome.

-

Whilst the platform is not accredited VerifiMe® is an accredited Australian Government Gateway Service Provider, meaning we can directly access the Governments Data Verification Service.

-

Verify that the person uploading the documents matches the IDs provided. Our face match AI offers extra protection against stolen IDs and impersonation.

-

VerifiMe uses AI-powered fraud detection, biometric authentication, liveness detection, and duplicate document checking to identify and prevent fraudulent activities before they occur.

-

A reusable identity wallet allows customers to store verified credentials securely and share them with multiple organisations without repeating the document uploading process. This reduces friction and improves customer experience.

-

No. While document verification is a vital step, a comprehensive risk assessment may also include liveness detection, PEP and sanctions screening, and adverse media checks.

-

With a shareable customer wallet and customisable compliance rules, your compliance team can easily make requests for customers to upload and share additional information. Further mitigation’s can be easily run from the portal allowing a record of the case work undertaken and to track audit reporting.

-

Yes. VerifiMe® supports over 15,000 document types from countries and regions worldwide.

What our customers are saying