KYC, AML/CTF compliance & Identity Verification Reimagined

Seamless Verification. Streamlined Compliance. Enhanced Security. Shareable.

The Problem with Traditional KYC

Every business asks for the same documents. Customers get frustrated. You handle sensitive data. Everyone wastes time and money.

Solved with VerifiMe

Elevate customer trust

Customers create a secure digital wallet with verified credentials. They control what they share and with whom, building trust and transparency.

Keep customer data secure

You never see or store driver's licenses, passports, or sensitive documents. Receive only verification results, dramatically reducing privacy liability.

Set your rules for compliance

Configure industry-specific requirements through our user-friendly portal. From AUSTRAC regulations to professional standards - we've got you covered.

Built for Every Business Need

-

Accountants

Empower your clients, achieve your proof of identity requirements, and be AML/CTF compliance-ready.

-

Fund & Asset Managers

Revolutionise your AML/CTF and ASIC requirements for customer due diligence.

-

Lawyers

Verify identities and minimise privacy risks to safeguard individuals and your business from fraudulent activities.

-

Real Estate Agents

Verify sellers and buyers faster, minimise privacy risks and be AML/CTF compliance-ready.

-

Everyone else

No matter your size, if you need to collect and verify personally identifiable information, we can help.

Trusted by Businesses

-

“ VerifiMe’s seamless verification solution saves time and eliminates the need to handle personally identifiable information. Highly recommended."

Victoria-Jane Otavski, Partner Blackbay Lawyers

-

“ Their understanding of regulatory compliance, support and the technology provided was exceptional."

Anthony Hersch CEO, Law Capital

-

"The VerifiMe team and platform have been instrumental in helping us achieve our AML-CTF objectives and stay up-to-date with wholesale investor compliance."

Renee Hetreles, Finance and Compliance Leftfield Capital Partners

-

"The platform’s efficiency in verifying clients and their agents has significantly streamlined our process"

Daniel Spears, Principal at Dunamis Advisory

-

“We found VerifiMe very easy to implement and allows us to meet our compliance objectives efficiently and cost effectively."

Sebastian Garufi, Garufi McDonald Chartered Accountant

-

"We have worked with the VerifiMe team to set up an ID verification process across stores in NSW, QLD and VIC. The process for customers is quick and easy."

Tony Vuong, Head of Operations, Kennards Self Storage

Get Started in 3 Simple Steps

Set up your Rules

Configure your compliance requirements and risk parameters through our intuitive portal. Takes 15 minutes to customize for your industry.

1

Test & Integrate

Invite your team to test the customer journey. Integrate via API, email invites, or QR codes into your existing workflow

2

Start onboarding

Go live instantly. Customers verify their identity and share securely. You get automated risk assessments and audit-ready reports.

3

Finally a KYC & Identity Verification solution that empowers both customer and clients

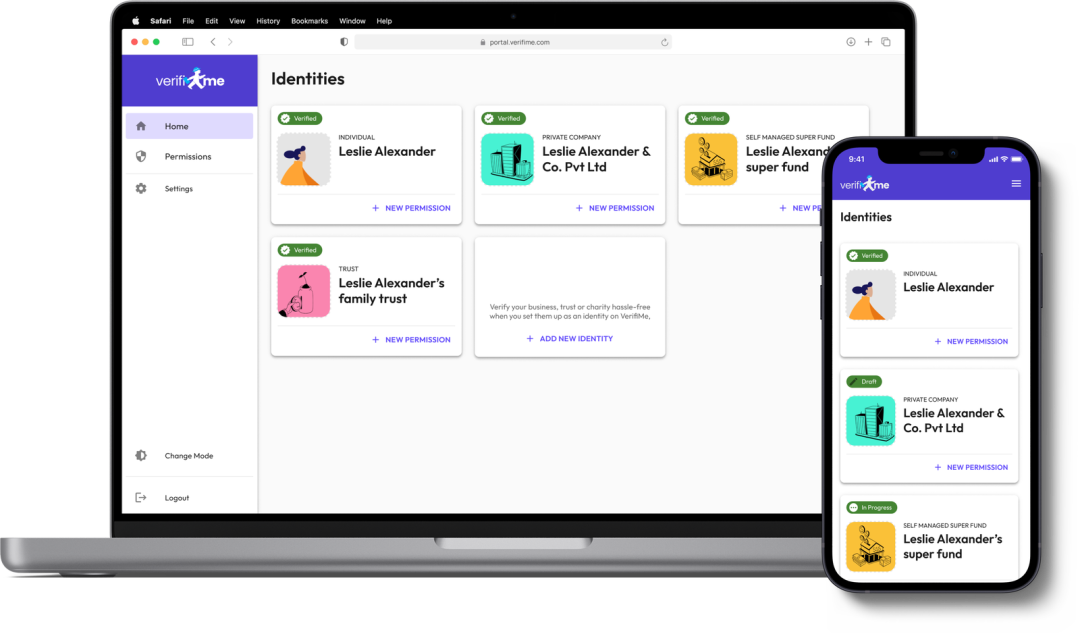

VerifiMe for

your customers

Break free from asking your customers to repeatedly fill out forms and share documents of personal information.

Use VerifiMe to allow your customers to prove who they are without risk of exposing their personal information. They can also use it to verify their SMSF, trust or company. It’s free to use and simple to set up.

VerifiMe for

your business

Elevate your customer experience and trust while minimising compliance and data security risks.

Automated customer acquisition, that is tailored to your rules. Helps you acquire customers and meet your rules of KYC and AML/CTF compliance now and in the future.

Insights

Ready to Transform Your Customer Onboarding?

Learn more about VerifiMe , by requesting a demonstration or a copy of our white paper.

Click on the Explore Product link to understand the advantages of VerifiMe compared to other identity/KYC verification service providers.

Understand what made our founders embark on this mission - About